The Bundling and Unbundling of the DevOps market

The DevOps market continues to grow:

The global development and operations (DevOps) market size stood at USD 3,709.1 million in 2018 and is projected to reach USD 14,969.6 million by 2026, exhibiting a CAGR of 19.1% during the forecast period.

Another interesting thing is its continued and accelerated consolidation. Just in H2 2020 Progress acquired Chef, Snyk acquired DeepCode and PagerDuty is acquiring Rundeck. This seems to be a trend that is accelerating over the last few years.

Consolidation is a result of maturity and competition. As technology is invented and winners are picked, incumbent players will accrue their value to be more competitive in their own playing field.

This would normally mean that it will be harder to create new products.

Except I don’t agree that this is the case. I think today is one of the most exciting moments for a company to ‘fly solo’ and provide fantastic vertical solutions. In this post, I explore why.

What is DevSecOps - read more here.

A note on what’s happening in the Market

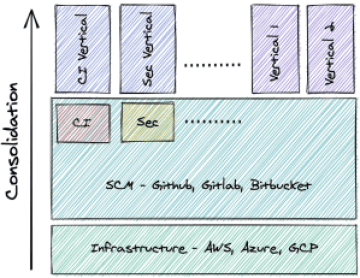

We see acquisitions left and right in the DevOps and Software Dev Tools market. This movement is driven by big players at the ‘bottom’ level of the market: the Cloud providers (AWS, Microsoft, Google). In their competition to become the de facto infrastructure of the internet, they’ve understood that developers’ eyeballs are the long term key driver of success. This is likely what drove Microsoft to buy Github. This is why AWS continuous to launch wave after wave of parallel value solutions. So that when developer teams choose a Cloud provider, they get persuaded by all the ways they can save time in developing products.

We further see this up the value chain. Github has accelerated its innovation pace and has brought many new features/verticals into its offering. This is likely in response to Gitlab but certainly accelerated after the MS acquisition.

Going further up, players that provide vertical value, like Security analysis, are also moving to conquer and develop their own moats in response to an accelerated market dynamic. An example is Snyk with the acquisition of DeepCode.

I explicitly mention ‘down and up’ because that’s for me a nice way of visualizing the market. That’s also useful as we can see Consolidation as a bottom-up force.

Consolidation of the DevOps and Dev Tools market. Solutions will acquire or build value upstream.

Consolidation of the DevOps and Dev Tools market. Solutions will acquire or build value upstream.

Example: SCMs have their own CI solution while also partnering with external parties

Consolidation and Fragmentation

Only two ways to make money in business:

One is to bundle; the other is unbundle.

Jim Barksdale

Every market is constantly bundling offers (larger players creating more product value) and unbundling (new players, choosing a vertical, and doing it better as a focus point). Bundling is when companies acquire more product value. Unbundling is when companies extract a vertical out of a larger player. Similar to how Unix functions or Craigslist sections became internet companies.

Competitive tensions are not only increasing but leading to consolidation, which is a bottom-up force in this analysis. Consolidation is further accelerated by how companies are looking to streamline procurement by cutting vendor relationships (i.e. management in a company will continuously try to reduce the number of suppliers for ease of management).

However, there are also factors that lead to fragmentation (or unbundling). The B2B market is not only becoming increasingly “consumerized”, which leads to higher expectations of B2B offerings ⇒ more competition but also the adoption of technology is increasingly bottom-up, which empowers the field (vs Management) to adopt tools.

These two conflicting forces (top-down and bottom-up) are changing the DevOps competitive landscape. Some people argue that the first force will win, which would mean the market is heading for even more consolidation and customers will have fewer suppliers offering much more value (certainly feels like we’re heading in that direction). This would in turn mean that there would be rules (or policy) within any company for the adoption of new technology (“if we’re a Github shop, we can’t let your team buy Gitlab”). Several companies, notably like Gitlab, are betting on this consolidation.

However, there’s a case to be built for Fragmentation as well.

The case for fragmentation

Historical data is the best way to predict the future. And, historically, companies acquire the best of breed technology to solve problems, in any area of the DevOps industry. The fact is that the larger the company the harder it is to enforce purchasing decisions and standards of the workflow.

Let’s look at programming languages as an example. It’s unrealistic to think that a company will become only a C# shop, especially the larger the company is. It’s even more unrealistic that that same company will move quickly from Java to C#.

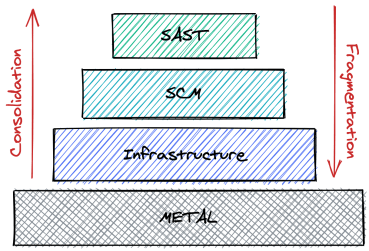

The point is that there is natural fragmentation in the DevOps market because of:

Consolidation and Fragmentation: two forces pushing from and to metal

- Competitive tension. Companies are trying to take over their space. AWS is a leader but Microsoft is investing heavily to displace them with product value (e.g. acquisition of Github) and discounted deals.

- The farther away we are from the metal, the more fragmented the market will be. A company most likely will not have more than 1 or 2 cloud suppliers. A company most likely will have multiple SAST tools ensuring development is safe.

From a different perspective, the Dev Tools and DevOps market is one of the most dynamic, quickly evolving markets there is. Every week, new tools emerge. The barriers to entry in making new tools have never been lower (because, again, consolidation enables streamline and democratization of development). So just by the law of large numbers, it is likely that, while most tools will not get critical adoptions, some will make the jump to becoming critical in the toolchain. Some will even transform the way we develop software. Think about how transformative Docker, K8s, and Serverless (which is still getting traction) were. It’s plausible to think that in the next 5 years more technology will emerge that will challenge the incumbent consolidating players today.

Consolidation also has its drawbacks. The more value you accrue the more you have to maintain. The more you have to maintain, the less likely you are to maintain it well enough to push off disruption. This is why unbundling offer from larger players is a good strategy. The larger player does have the resources but not the focus. It is a fact that larger companies are behaving more and more like startups in their execution speed. But cadence in product innovation requires fewer strings to be attached to. One of the products I’ve been most impressed by recently is Obsidian, with 2 founders/developers able to ship new features every week.

Finally, you can always count on developers to choose new and better ways to do things. In this case, the developer community likes to adopt technology from the bottom up. This is how Dropbox and Slack went to market: by getting teams within a company to use their product, becoming sticky, and expanding within an organization. So it is a force against consolidation. Unless of course, the developer experience of the consolidated offer is so sublime that developers vouch for it. When companies have to choose between buying the best in class software for their developers VS minimizing the number of vendors to streamline procurement, we have to remember that companies spend roughly 25% of budget/revenue in R&D.

Now, companies that fragment the market today might end up being acquired in the future. In fact, that is the likely outcome for many dev tools. What I am saying is that there is a land of opportunity open and that consolidation only exists if new companies get started every year.

I’m also not saying that the best route for a startup is to be independent regardless of market conditions or exit opportunities. I am saying that there is enough opportunity for a company post-market fit to have a bright future and to grow beneath the giants.

Conclusion

The DevOps and Dev Tools market is undoubtedly consolidating for the last few years. But I argue that this is a time of opportunity and that it shouldn’t push off anyone thinking of developing new solutions for companies that develop software. Fragmentation is a real, and likely more invisible, force that is omnipresent and will not go anywhere soon given how developers adopt technology (bottom-up).

It has never been more exciting to launch a dev tools offer.

Thanks to Inês Barros, João Caxaria, and Anthony Douglas for reviewing this post.

.svg)